Bitcoin's Dip: What Happened?

Title: Bitcoin's Bubble Bursts as Gold Glows: Is the Crypto Party Over?

The crypto faithful are waking up to a harsh November hangover. While gold and silver are flexing their safe-haven muscles, Bitcoin and its digital brethren are looking decidedly…deflated. Bitcoin's down over 9% this month, slipping below that psychological $100,000 mark. Ethereum, Solana, even DOGE are getting hammered harder, down 11% to 20%. XRP, bless its heart, is only down 7%. Relative resilience, I guess you could call it.

The Usual Suspects Aren't to Blame

You'd expect a surging dollar to be the culprit, but the dollar index (DXY) is losing steam. Normally, a weak dollar is rocket fuel for crypto and precious metals. So what gives? Greg Magadini at Amberdata thinks the market’s just run out of hopium. All the "good news" – Fed easing whispers, US-China trade détente, that fleeting government shutdown resolution – it's all priced in. Bitcoin traders were betting big on a year-end rally, but now they're stuck holding the bag, with no fresh buyers in sight.

And here's the part I find genuinely unnerving: Magadini flags the risk of a credit freeze hitting Digital Asset Treasuries (DATs). These are the entities that have been juicing the crypto market for the past year, funding their coin binges with borrowed money – convertible bonds, debt issuance, the whole shebang. But DATs aren't the only ones chasing credit; sovereign governments and AI startups are all clamoring for the same limited pool.

If the credit spigot tightens, these DATs could get squeezed. They’d have to dump their crypto holdings to cover their debts, triggering a fire sale. It’s a domino effect – one DAT liquidates, forcing others to do the same. Magadini points out this is particularly dangerous for DATs that piled into volatile altcoins at peak valuations. (DATs in the Far East are already feeling the heat, apparently.)

Gold's Gain is Crypto's Pain?

Meanwhile, gold and silver are shining. Gold's up 4% this month, silver's up 9%, and even those forgotten precious metals like palladium and platinum are seeing gains. The reason? Good old-fashioned fear about the global economy. Fiscal strain is front and center. Look at government debt-to-GDP ratios: Japan's over 220%, the US is above 120%. France and Italy are lugging around debt burdens north of 110%. Even China, while its government debt-to-GDP is below 100%, its total non-financial debt is over 300% of GDP. That's a lot of red ink.

Robin Brooks at Brookings points the finger at the Eurozone, where high-debt countries are calling the shots at the ECB. Is this a flight from the dollar? Brooks thinks it's a deeper problem: fundamentally broken fiscal policy, globally.

Now, here's a fun fact: gold has a history of leading Bitcoin. One analysis suggests Bitcoin lags gold by about 80 days. So, if gold's rally stalls, Bitcoin might get a boost. Might. Whether that pattern holds in this bizarre macroeconomic climate is anyone's guess. And that's the problem with these "expert" predictions; they're always based on past performance, which, as every disclaimer reminds us, is no guarantee of future results.

The question I keep asking myself is: are we seeing a fundamental shift away from speculative digital assets and back to tried-and-true safe havens? Or is this just a temporary blip on the radar? I’ve looked at hundreds of these market reports, and this divergence between crypto and precious metals feels…different. More decisive. Why Bitcoin (BTC), XRP (XRP), Ether (ETH) Tank While Gold, Silver Shine Bright?

The Crypto Experiment: Proceed With Caution

The data paints a clear picture: Bitcoin's allure is fading as global economic anxieties rise. The easy money fueled by cheap credit is drying up, exposing the vulnerabilities of DATs and the broader crypto ecosystem. While correlation isn't causation, the fact that gold is surging while Bitcoin falters suggests investors are prioritizing stability over speculative gains. It's a reality check for the crypto faithful and a reminder that even in the digital age, some things – like the appeal of gold in times of crisis – remain timeless.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

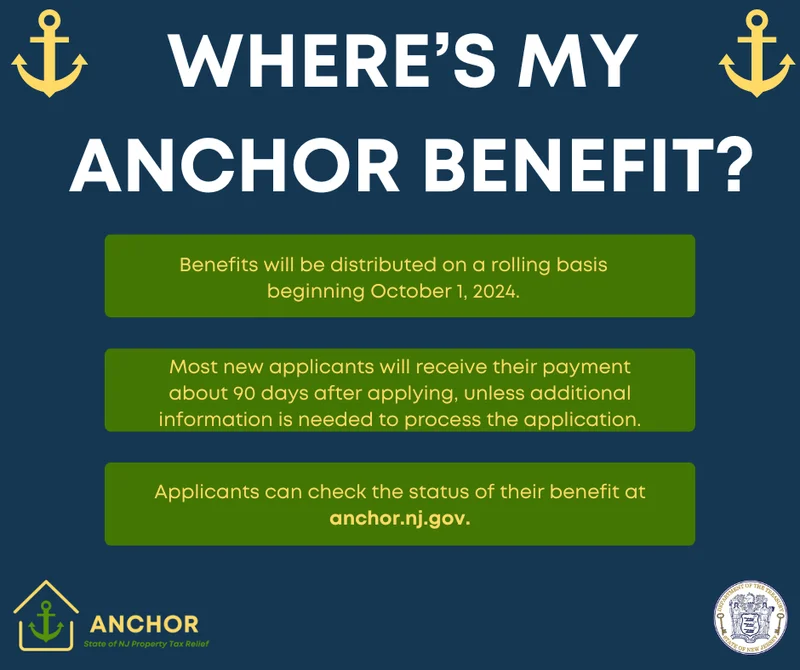

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Microsoft Stock: AI Revolution vs. Investor Jitters

- John Ternus at Apple: Net Worth, Age, and Tim Cook Succession Plans

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- USAA Insurance: Car, Life, and Health—What We Know

- Nvidia Stock: Huang's "Incredible News" vs. What the Price is Actually Doing

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)