CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

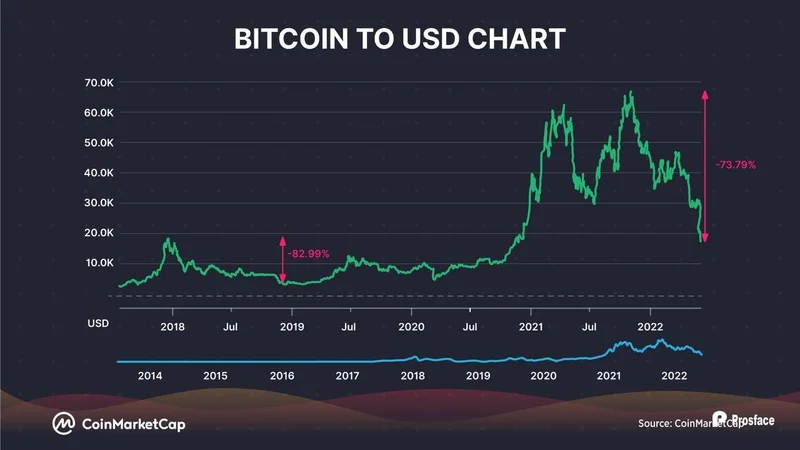

A Crypto Winter Forecast: Morgan Stanley's "Fall Season" is Just Getting Started

Oh great, another "expert" telling us what's what with the crypto market. Morgan Stanley strategists are now saying we're in the "fall season" of Bitcoin's four-year cycle? Give me a break. It's always "seasons" and "cycles" with these guys, never just plain old volatility and speculation. According to a recent Bitcoin Price in 'Fall' Phase of 4-Year Cycle, Say Morgan Stanley Strategists article, this is based on historical data.

Denny Galindo, some investment strategist at Morgan Stanley Wealth Management, says historical data indicates a "consistent three-up, one-down rhythm" in Bitcoin's price cycles. Okay, Denny, so you're saying it goes up, then it goes down? Groundbreaking analysis there, pal. Next you'll tell me water is wet.

And this whole "institutional investors evaluating their position strategies" bit? Translation: they're panicking and trying to figure out how to not lose their shirts after dumping billions into magic internet money. It's all so predictable.

The Illusion of Institutional Stability

Michael Cyprys, head of U.S. brokers and asset managers at Morgan Stanley Research, claims institutions "increasingly view Bitcoin as digital gold or a macro hedge against inflation and monetary debasement." That's the line, anyway. What they actually view it as is a speculative asset they can pump and dump to make a quick buck, while telling everyone else it's a "long-term investment." Don't fall for it.

He goes on to say that institutional allocations "move deliberately due to internal processes, risk committees, and long-term mandates." Right, because bureaucracy somehow makes bad investments sound. Newsflash: slow and steady still loses the race if you're betting on a horse that's already dead.

U.S. spot Bitcoin ETFs hold over $137 billion in total net assets, while spot Ethereum ETFs manage $22.4 billion, according to SoSoValue data. Impressive numbers, sure. But it just means there's that much more money at risk when this whole thing implodes.

The Rise of "Layer 1" Chains and Token Mania

Speaking of implosions, let's talk about these new "Layer 1" blockchains popping up left and right. Story, Plasma, whatever... they all promise to revolutionize something or other. Story wants to be the "foundation for intellectual property (IP) on the internet"? Plasma is "building the stablecoin infrastructure for a new global financial system"? Yeah, and I'm gonna be the king of England.

These "innovations" are just new ways to separate fools from their money. Story has its $IP token, used for "paying transaction fees," "registering IP assets," "licensing IP assets," "participating in governance," and "staking for network security." It's like they just threw a bunch of buzzwords into a hat and picked them out at random. You can see the current Story price today at CoinMarketCap.

And don't even get me started on Bitget Token (BGB) and their "strategic partnership" with the Morph chain. "Led by a team of visionary early adopters committed to a blockchain-powered future"? That's what they all say. Visionary early adopters committed to lining their own pockets, more like it.

Oh, and I saw a headline about Bitcoin falling below $99,000. Was it yesterday? Last week? Doesn't even matter anymore. The numbers are meaningless. Up, down, sideways... it's all just noise.

Are We Being Played?

The whole crypto space feels like one giant, elaborate game designed to transfer wealth from the gullible to the already rich. These "four-year cycles" and "institutional investments" are just fancy ways of masking the underlying truth: it's all speculation, all the time. And when the music stops, guess who's left holding the bag?

But hey, maybe I'm wrong. Maybe Bitcoin really is the future of finance. Maybe these Layer 1 chains will revolutionize everything. Maybe institutional investors actually care about something other than their own bottom line. Then again, maybe pigs will fly.

It's a House of Cards

The scary part is, the hype is so strong, and the fear of missing out so pervasive, that even I sometimes wonder if I'm being too cynical. Then I snap out of it and remember: if it sounds too good to be true, it probably is. And the crypto market, with its promises of instant riches and decentralized utopias, sounds way too good to be true.

So, What's the Real Story?

It's a bubble, plain and simple. And like all bubbles, it's gonna burst. The Morgan Stanley "fall season" ain't nothing compared to the coming ice age. Get your popcorn ready.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

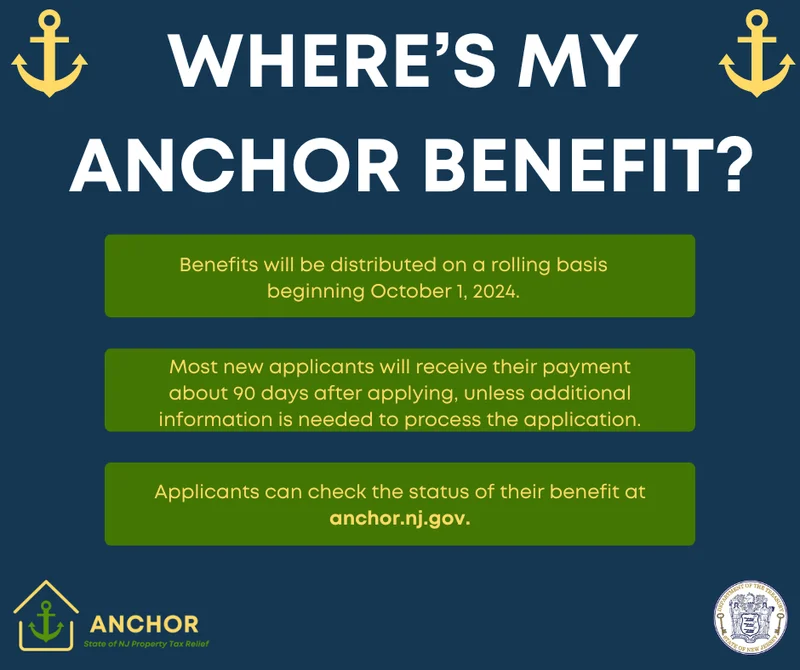

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- USAA Insurance: Car, Life, and Health—What We Know

- Nvidia Stock: Huang's "Incredible News" vs. What the Price is Actually Doing

- Bitcoin's Bear Market: Price Trends and What We Know

- Hyundai's Labor Lawsuit: Child Exploitation Allegations and Industry Impact

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)