Bitcoin's Bear Market: Price Trends and What We Know

Bitcoin Heats Homes? A Data-Driven Reality Check

Crypto's Cozy Claims: Fact or Fiction?

The promise of bitcoin mining heating homes is making the rounds again. The idea: use the otherwise wasted heat generated by those power-hungry crypto rigs to warm your house, apartment, or even a commercial wash bay. It’s a seductive vision of efficiency, a way to squeeze value out of a process often criticized for its environmental impact. But let’s run the numbers and see if this dream holds up to scrutiny.

K33, a digital assets brokerage, claims the bitcoin mining industry generates about 100 TWh of heat annually – enough to heat all of Finland. That’s a big number, but it's also a very broad one. The real question is: how much of that heat is actually recapturable and economically viable to repurpose?

Jill Ford, CEO of Bitford Digital, suggests rerouting the heat from bitcoin rigs through a home's ventilation system. Sounds simple enough, but let's consider the practicalities. A single mining machine might be sufficient, she says, especially if solo miners join mining pools. But Derek Mohr, a professor at the University of Rochester, throws cold water on this idea. He argues that home computers, or even networks of them, have almost zero chance of successfully mining a bitcoin block these days. Mining has become too specialized, dominated by massive farms using custom-designed chips.

The Devil in the Details: Efficiency and Economics

The core issue is efficiency. Mohr points out that these "bitcoin heat devices" are essentially space heaters powered by your own electricity. "Yes, bitcoin mining generates a lot of heat, but the only way to get that to your house is to use your own electricity," he says. In other words, you're just converting electricity into heat, with the added complexity (and inefficiency) of the bitcoin mining step.

I've looked at hundreds of energy efficiency reports, and there's a general truism: the fewer conversion steps, the better. Each step introduces losses. Turning electricity into bitcoin mining, then turning the waste heat from that mining back into usable heat for your home? That's a recipe for thermodynamic disappointment.

The argument shifts to offsetting costs. Ford claims it's "the same price as heating the house, but the perk is that you are mining bitcoin." But this relies on a very specific set of conditions: favorable electricity rates, a fast mining machine, and a consistently profitable bitcoin price. (And let's not forget the initial cost of the mining rig itself, plus the ongoing maintenance).

Andrew Sobko, founder of Argentum AI, suggests the concept makes more sense in larger settings, like data centers or industrial parks. This is where the scale can potentially overcome the inefficiencies. Nikki Morris, executive director of the Texas Christian University Ralph Lowe Energy Institute, echoes this, envisioning apartment complexes with crypto mining setups producing both digital currency and usable heat energy.

But even here, the logistics are tricky. As Sobko notes, you can't just truck the heat somewhere. You have to co-locate the computing power where the heat is needed. This introduces a whole new set of constraints and costs.

One notable example is Cade Peterson's company, Softwarm, in Challis, Idaho. They're repurposing bitcoin heat for businesses, like a car wash where it's used to melt snow and warm the water. Peterson claims the owner is now making more money in bitcoin than it costs to run the miners. An industrial concrete company is also using bitcoin heat to offset its water tank heating bill.

The key here is likely the specific economics of Challis, Idaho: potentially low electricity costs and a high demand for heat. It's a localized solution, not a universal one. And even in these cases, we need to see detailed energy audits to verify the actual savings and efficiencies.

The Hype vs. Reality

The Scaramucci's investment in American Bitcoin adds another layer to this story. While Anthony Scaramucci has been a vocal critic of Trump, his firm, Solari Capital, led a $220 million funding round in the Trump family's bitcoin mining firm. AJ Scaramucci, Anthony's son, was roommates with the president of American Bitcoin. “Matt is one of my closest personal friends,” AJ said. Scaramuccis led $220 million investment in crypto mining firm tied to President’s family.

The involvement of high-profile investors and the political connections add to the hype, but they don't change the underlying thermodynamics. Bitcoin's bear market week, with Bitcoin down over 20% from its all-time high, is a stark reminder of the volatility of the industry.

Is Bitcoin Heating a Pipe Dream?

Ultimately, the promise of bitcoin heating homes is a classic case of "sounds good in theory, but..." The fundamental problem is the inherent inefficiency of converting electricity into bitcoin mining and then trying to recapture the waste heat. While there may be niche applications where it makes economic sense, it's unlikely to become a widespread solution anytime soon.

Just Another Greenwashing Scheme?

It's tempting to see bitcoin heating as another attempt to greenwash the crypto industry. The idea that you can somehow offset the massive energy consumption of bitcoin mining by using the waste heat? The numbers just don't add up.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

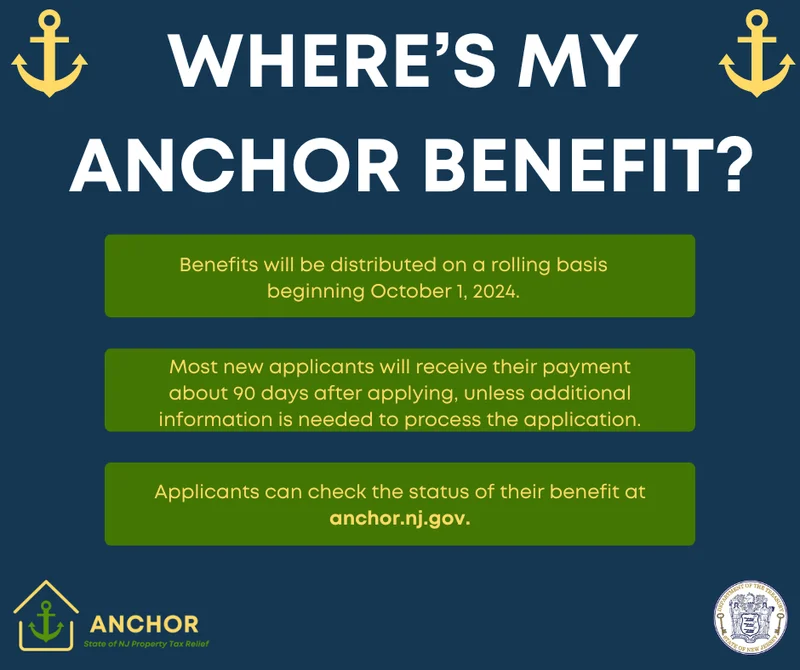

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- USAA Insurance: Car, Life, and Health—What We Know

- Nvidia Stock: Huang's "Incredible News" vs. What the Price is Actually Doing

- Bitcoin's Bear Market: Price Trends and What We Know

- Hyundai's Labor Lawsuit: Child Exploitation Allegations and Industry Impact

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)