Firo Hard Fork: What to Expect and Why It Matters

Generated Title: FIRO's 450% Surge: Privacy Play or Pump and Dump?

The Privacy Coin Rollercoaster

FIRO's recent price action is hard to ignore: a 450% surge since September, pushing against the $3 resistance level that's held for nearly three years. The question, as always, is whether this is a legitimate breakout based on fundamentals, or just another crypto flash-in-the-pan fueled by hype. The marketing material certainly wants you to believe the former.

The narrative being pushed is that the surge is driven by renewed interest in privacy coins and the launch of Firo’s Spark Assets, which allows developers to mint privacy-first tokens. And, granted, the Spark Assets rollout does seem to have driven some on-chain activity, with rising daily active addresses and higher transaction volumes. But here's where the data needs a closer look.

While the price has jumped significantly, social sentiment, while positive, remains relatively muted. The fact that interest is "organic, rather than being driven by Key Opinion Leaders (KOL)" is being touted as a positive. But frankly, it’s a double-edged sword. A lack of broader awareness means this rally is built on a relatively small foundation. If the whales decide to take profits, there aren't enough new entrants to hold the line.

The other aspect to consider is the hard fork scheduled for November 19th. These events often create short-term price pumps as people buy in anticipation of "free money" (though, of course, it rarely works out that way). The hard fork promises Spark Name transfers and reduced GPU VRAM requirements for mining. The latter is interesting, as it potentially broadens the base of miners, which could increase network security.

Technicals vs. Fundamentals

Technically, FIRO is at a critical juncture. The weekly chart suggests a potential breakout if it can decisively close above $3, targeting $4.80. However, the daily chart paints a more cautious picture. There are signs of a five-wave upward movement completing, potentially leading to an A-B-C correction down to the $1.47 to $1.84 support level. The bearish divergence on the Relative Strength Index (RSI) further supports this possibility.

Now, here's where my analysis diverges from the typical "technical analysis" you see plastered across crypto blogs. These patterns are self-fulfilling prophecies. If enough traders believe a correction is coming, they'll sell, causing the correction. It's game theory, not astrophysics.

The other argument being made is that FIRO’s exchange balance has dropped by more than 21%, suggesting strong accumulation despite the fear that dominated November. This is true, but it also needs to be seen in context. A 21% drop sounds impressive, but we need to know who is doing the accumulating. Is it long-term holders, or just short-term speculators looking to flip a quick profit? The data isn't granular enough to tell. And this is the part of the report that I find genuinely puzzling: Why isn't there more data on the types of wallets accumulating FIRO? Are these new wallets, or existing ones? Are they associated with known entities? This is the kind of on-chain analysis that separates signal from noise.

Even with the nearly fivefold increase in market cap, FIRO remains a low-cap altcoin. Many believe that escaping the 2025 accumulation zone could allow FIRO to move further and possibly reach 10 USD in 2026. "FIRO has been trending #1 on Coingecko for an entire week. When the tech is truly great, the interest speaks for itself. Billions,” – Investor Zerebus commented. But keep in mind that low-cap altcoins carry higher risk. Their lower liquidity can lead to sharper volatility during market downturns. 3 Low-Cap Altcoins Surging After Long-Term Accumulation

The launch of Spark Assets is presented as a major driver of utility. Spark Assets lets developers mint privacy-first tokens — stablecoins, NFTs, and other instruments — that all share one anonymity pool. This makes a private stablecoin indistinguishable from an $FIRO transfer, and every asset creation or private transaction requires FIRO tokens. That structural change converts Firo from a stand-alone privacy coin into a privacy infrastructure layer.

The community also faces a mandatory software update before the scheduled hard fork on November 19, 2025 — upgrade v0.14.15.0 introduces Spark Name transfers and lowers GPU VRAM mining requirements to include 8GB cards. Firo to Undergo Hard Fork on on November 19

A Privacy Coin With a Question Mark

So, is FIRO a legitimate privacy play, or just another pump and dump? The answer, as always, is somewhere in the middle. There are genuine reasons to be optimistic: the Spark Assets rollout, the upcoming hard fork, and the renewed interest in privacy coins. But there are also red flags: the muted social sentiment, the potential for a technical correction, and the lack of detailed on-chain data.

Ultimately, investors should watch how on-chain adoption for Spark Assets evolves. If Spark Assets continue to attract cross-chain activity through partners like Confidential Layer, FIRO may see steady utility-led demand. Conversely, a failed test and weaker liquidity could prompt deeper pullbacks.

Is This Rally Sustainable?

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

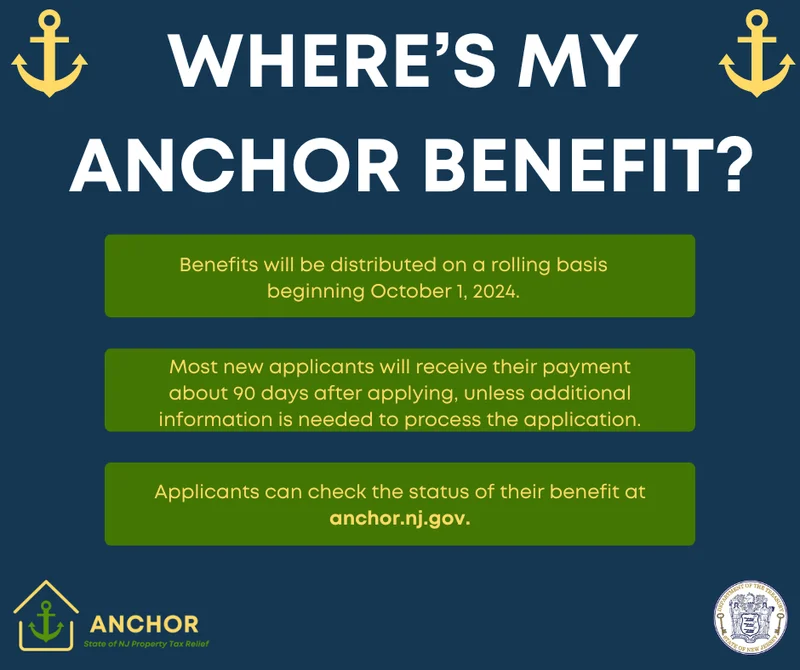

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- USAA Insurance: Car, Life, and Health—What We Know

- Nvidia Stock: Huang's "Incredible News" vs. What the Price is Actually Doing

- Bitcoin's Bear Market: Price Trends and What We Know

- Hyundai's Labor Lawsuit: Child Exploitation Allegations and Industry Impact

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)