Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

Okay, folks, buckle up. Because something HUGE just happened, and it's not just about Berkshire Hathaway dropping $4.3 billion on Alphabet (GOOGL). It’s about what that investment signals. We're talking about a seismic shift—the old guard, the titans of traditional value investing, finally seeing the long-term, world-altering potential of AI.

For years, Warren Buffett has been known for his love of steady, predictable businesses—Coca-Cola, American Express, companies that, let's be honest, aren't exactly on the bleeding edge of technological innovation. But now? Now, he's betting big on a company that’s not just a search engine; it’s a sprawling AI research lab, a cloud computing giant, and a playground for moonshot ideas that could redefine our future.

This isn't just about Alphabet's current dominance in search and advertising. It's about the future. It's about recognizing that AI isn't just a buzzword; it's the next industrial revolution. Think about it: Alphabet is at the forefront of self-driving cars (Waymo), AI-powered healthcare (Verily), and, of course, the AI that’s rapidly transforming…well, everything.

The Tipping Point

What does it mean when the most respected value investor on the planet throws billions at a tech company? It's like Gutenberg deciding to invest in the printing press—a clear sign that a paradigm shift is underway. Buffett’s move is a powerful validation of AI’s long-term value, and it could inspire other institutional investors to reconsider their strategies in a rapidly evolving industry. When I first read about this, I felt a jolt of excitement because this is the kind of thing that will push the industry to innovate faster. Berkshire Hathaway’s $4.3 Billion Investment Signals Confidence in Alphabet (GOOGL) Stock

Remember those headlines from last year, the ones fretting about tech stocks being overvalued, about regulatory scrutiny, about the "techlash"? Well, Berkshire's investment is a giant middle finger to that negativity. The market has been jittery, sure, but Buffett's team is clearly playing the long game, betting on Alphabet’s ability to weather the storms and deliver long-term shareholder value.

And let's be clear: this isn't just about the numbers. It's about the vision. It’s about recognizing that Alphabet, despite its size and complexity, is still driven by a relentless pursuit of innovation. It’s a company that’s not afraid to take risks, to invest in long-term projects that might not pay off for years, but that have the potential to fundamentally change the world.

Of course, Alphabet faces challenges. Antitrust investigations, competition from other tech giants, and the constant pressure to innovate are all real concerns. But Berkshire's investment suggests that they see more opportunity than risk. And that, my friends, is a powerful statement.

What does this mean for us, the everyday investors, the tech enthusiasts, the dreamers? It means that the future is closer than we think. It means that AI is not just a technology for Silicon Valley elites; it's a force that will shape our lives in profound ways. But let's also remember the ethical considerations. With great power comes great responsibility, and as AI becomes more pervasive, we need to ensure that it's used for the benefit of all, not just a select few.

The Dawn of AI Confidence

This is more than just an investment; it's a vote of confidence in the future. A future where AI transforms our world, and where even the most traditional investors are willing to bet big on its potential.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

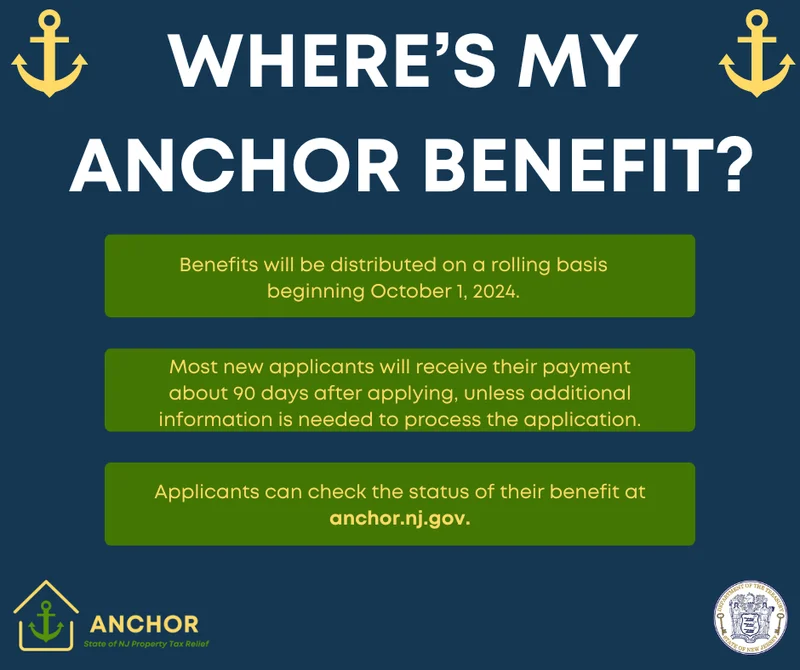

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- John Ternus at Apple: Net Worth, Age, and Tim Cook Succession Plans

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- USAA Insurance: Car, Life, and Health—What We Know

- Nvidia Stock: Huang's "Incredible News" vs. What the Price is Actually Doing

- Bitcoin's Bear Market: Price Trends and What We Know

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)