Bitcoin ETF Outflows: A Temporary Dip on the Road to Revolution?

Bitcoin's Bumpy Ride: A Blip on the Radar or a Sign of Something Bigger?

Okay, folks, let’s talk about this dip in the crypto market. I know, I know – headlines are screaming about billions in outflows from Bitcoin and Ether ETFs, and Bitcoin hitting six-month lows. It's enough to make anyone nervous. But before you sell everything and run for the hills, let's take a breath and put this into perspective, shall we?

What we're seeing isn't necessarily a sign of impending doom, but rather a market doing what markets do: correcting. Think of it like a forest after a controlled burn. Sure, it looks scorched for a while, but it clears the way for new growth, stronger and more resilient than before. Crypto, especially Bitcoin, has always been volatile. It’s part of the package. What did we expect, a straight line to the moon?

The XRP Surge: A Glimmer of Hope?

Now, let’s flip the script for a second. While Bitcoin and Ethereum are seeing outflows, something truly remarkable is happening with XRP. Canary Capital’s spot XRP ETF (XRPC) smashed expectations, opening with $58 million in first-day trading volume. $58 million! That's the strongest debut of any ETF this year! I mean, Bloomberg analysts were projecting around $17 million, and XRPC blew past that in half an hour. The fund cleared that within half an hour, and narrowly bested the performance of the Bitwise Solana Staking ETF (BSOL), which opened with $57 million when it launched two weeks ago. What does this tell us? It tells us that there's still massive interest in crypto, just maybe shifting to other areas. It reminds me of the early days of the internet – everyone was focused on a few key players, but then suddenly, a new platform or application would explode in popularity.

BSOL has already generated more than $550 million in net inflows, although on Thursday it totaled just $1.5 million.

And let's not forget about the Bitwise Solana Staking ETF (BSOL). It may not have had the splashy debut of XRPC, but it's already generated more than $550 million in net inflows. This shows that investors are still looking for innovative ways to participate in the crypto space. Is this a sign that the market is maturing, with investors becoming more discerning about where they put their money?

Speaking of innovation, Bitfarms, a publicly traded Bitcoin miner, is pivoting to AI infrastructure after a $46 million loss. Now, some might see this as a failure, but I see it as a smart move. These companies are recognizing that the future is about more than just mining Bitcoin. They are seeing that the underlying technology has applications far beyond cryptocurrency. It's like when the railroads realized they could transport more than just goods – they could transport people too!

What does this mean for the future of crypto? Well, it's hard to say for sure. But one thing is clear: the market is evolving. We're seeing a shift from the early days of Bitcoin maximalism to a more diverse and sophisticated ecosystem. Investors are becoming more selective, and companies are adapting to the changing landscape.

Think about it: The internet went through its own "dot-com bubble" crash. Did that kill the internet? Of course not! It just weeded out the unsustainable projects and paved the way for the Amazons and Googles of the world to rise. This could be the same thing for crypto.

I will say, though, that while I'm optimistic, we need to be mindful of the potential risks. With great power comes great responsibility, and as crypto becomes more mainstream, we need to ensure that it's used for good. What are the ethical implications of these new technologies? How can we ensure that they are used to create a more just and equitable world? These are questions we need to be asking ourselves.

The Crypto Revolution is Far From Over!

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

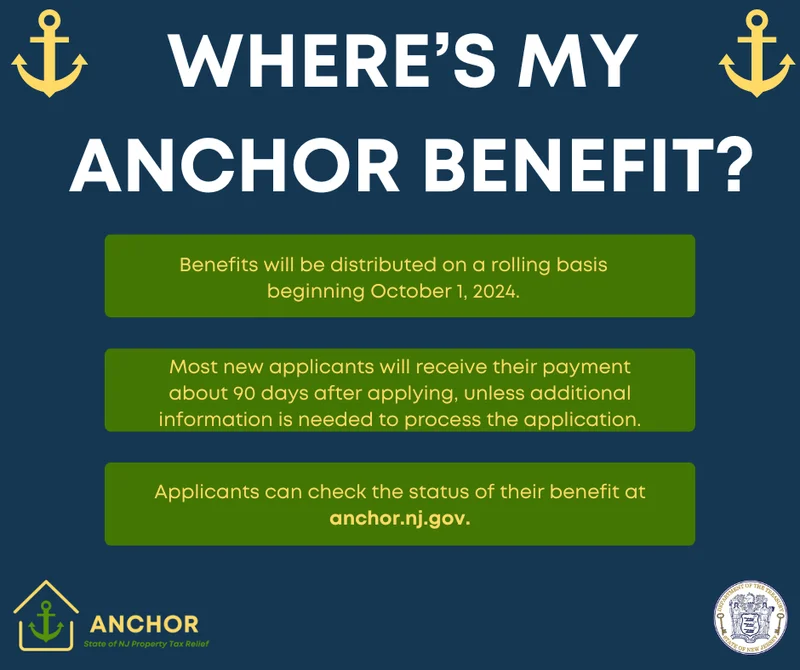

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Microsoft Stock: AI Revolution vs. Investor Jitters

- John Ternus at Apple: Net Worth, Age, and Tim Cook Succession Plans

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- USAA Insurance: Car, Life, and Health—What We Know

- Nvidia Stock: Huang's "Incredible News" vs. What the Price is Actually Doing

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)