Pudgy Penguins' Price Prediction: Risks Mount

PENGU's Kung Fu Panda Crossover: A Distraction From Deeper Issues?

Pudgy Penguins, the NFT project turned multi-media brand, has announced a collaboration with Dreamworks' Kung Fu Panda. On the surface, this looks like a win – a major IP partnership to expand brand reach. Igloo, the parent company, has been strategically aligning with other brands this year, including Roblox and NASCAR. They even hit a million downloads on their mobile game, Pudgy Party, in under a month. But let's dig into what this really means for PENGU token holders.

The press release highlights the expansion into physical toys, Web2 and Web3 games, and now a partnership with Dreamworks. But the PENGU token's price trajectory tells a different story. While the announcement is positive PR, the token is down 25% in the last seven days, and 76% since its all-time high. I've seen this pattern before: splashy announcements designed to mask underlying weakness.

The key question is: does a Kung Fu Panda penguin actually drive sustainable value for the token? Or is it just a shiny object to distract from deeper problems?

PENGU launched on Solana in December 2024, positioning itself as more than just an NFT – a key to governance and exclusive benefits. One source gushes about PENGU embodying a "vibrant blend of charm and communal spirit." But charm doesn't pay the bills.

The tokenomics are worth a closer look. The max supply is capped at roughly 88.88 billion PENGU. The community airdrop burned about 13.69% of the total supply, tightening the expected float. At least, that's the theory. But burns only matter if there's sustained demand. Allocation-wise, nearly 18% is allocated to the team with a one-year cliff and three-year vesting. (Vesting schedules are always something I scrutinize closely). A large unlock could create sell pressure, regardless of how many pandas are on the marketing materials.

Speaking of marketing, consider the claim that PENGU's trading volume averages $177.9 million per day. That sounds impressive, but what's the quality of that volume? Is it organic buying, or wash trading inflating the numbers? High volume during rallies can suggest liquidity, but it can also mask distribution by insiders.

I've looked at hundreds of these volume reports, and this particular figure raises questions. Are those numbers sustainable, or a short-term blip driven by speculative hype?

Examining the Roadmap & Community Hype

The roadmap outlines utility pillars: Pudgy World purchases, gaming features, governance, and staking/liquidity incentives. These are supposed to drive demand. But many of these features aren't fully live yet. Delivery risk is real and can mute any positive impact from the Kung Fu Panda partnership. One article boasts about retail tie-ins at Walmart, Target, and Amazon, using QR codes to link to Pudgy World. That's a smart move, bridging Web3 to everyday buyers. But how many of those casual shoppers are actually converting into active PENGU users? Hard to say.

Another source states PENGU's all time high (ATH) was approximately $0.06845 on December 17, 2024. By late October 2025, it was significantly lower, hovering between $0.021 and $0.031. That's a drop of over 50% (to be more exact, closer to 60%). This pattern of early hype, peak, and subsequent retrenchment is a red flag.

The community is often touted as a strength. Active users amplify partnerships and news, fueling short-term attention. But hype without long-term retention is just noise. What are the daily/monthly active user numbers for Pudgy World? How many users are actively participating in governance? If those numbers are weak, the Kung Fu Panda collab is just lipstick on a penguin.

Here's where my analysis gets a bit more subjective. The online chatter is positive, but it's also heavily influenced by "hopium" – the belief that any news is good news. I'm seeing a lot of "PENGU to the moon!" and "This partnership is huge!" But I'm not seeing a lot of data to back it up.

The key support levels sit at $0.032, $0.029, and $0.025, with immediate resistances near $0.039, $0.042, and $0.046. If PENGU breaks through those resistance levels with volume, then maybe, just maybe, the Kung Fu Panda partnership is more than a distraction. But until then, I remain skeptical.

Brand Buzz or Real Value?

The Kung Fu Panda partnership might bring new eyeballs to the Pudgy Penguins ecosystem. It might drive increased token utility. But until I see concrete data – sustained user growth, increased on-chain activity, and a stabilization of the price – I'm treating this as a marketing stunt, not a fundamental shift in the token's prospects.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

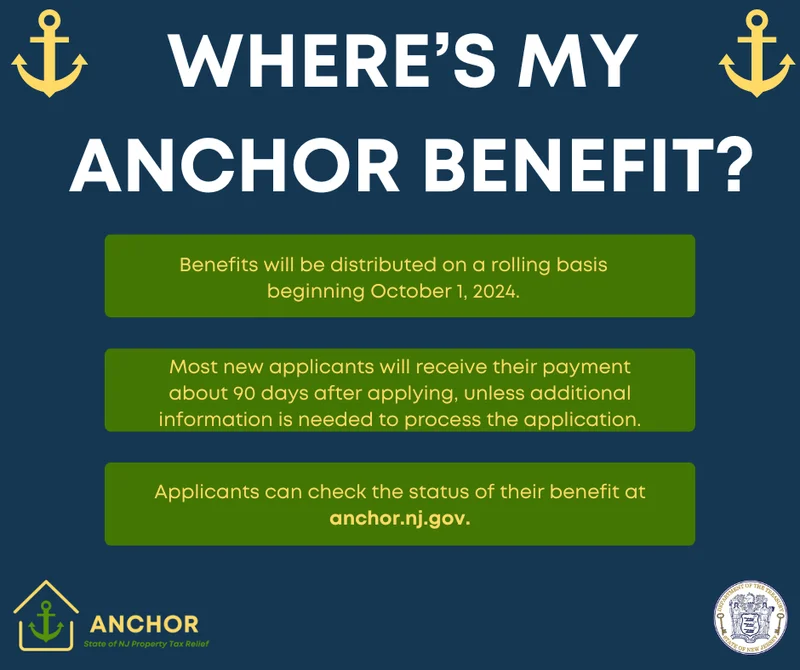

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Microsoft Stock: AI Revolution vs. Investor Jitters

- John Ternus at Apple: Net Worth, Age, and Tim Cook Succession Plans

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- USAA Insurance: Car, Life, and Health—What We Know

- Nvidia Stock: Huang's "Incredible News" vs. What the Price is Actually Doing

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)