Zcash Treasury Launch: Price Predictions and Reddit Reactions

Alright, let’s unpack this Cypherpunk Technologies situation. Leap Therapeutics, a biotech firm, suddenly pivoting to a Zcash (ZEC) treasury strategy? It’s either a stroke of genius or a spectacular faceplant waiting to happen. My job is to sift through the noise and see what the numbers actually tell us.

The Rebrand and the Bet

First, the facts. Leap Therapeutics is now Cypherpunk Technologies (CYPH), ticker symbol change effective November 13, 2025. They've sunk $50 million into 203,775.27 ZEC tokens, averaging $245.37 a pop. This was fueled by a $58.88 million private placement led by Winklevoss Capital. Winklevoss Capital being the VC firm run by the Gemini founders.

The rationale? They’re buying into the “digital privacy in asset form” narrative, positioning Zcash as digital gold, like Bitcoin (BTC). They aim to control 5% of the total Zcash supply. Okay, ambitious.

Here's where my analyst senses start tingling. They're betting big on privacy coins at a time when regulatory scrutiny is tightening. Zcash did surge tenfold in two months, peaking near $735 before settling around $464, but it's still way off its 2016 high of $3,191. That's a steep climb to regain. Is this a value play, or catching a falling knife?

The "official" story is that Cypherpunk is dedicated to self-sovereignty. As the world becomes increasingly digitized, privacy has become a rare and vanishing resource. And despite their critical importance, privacy enhancing technologies remain under-adopted. Backing privacy today is both a generational mission and a massive opportunity. Privacy is the foundation that allows freedom of speech, thought, and association to thrive. Without it, these societal tentpoles may exist on paper but can't be exercised meaningfully in practice. In other words, privacy is the silent precondition of freedom. Additionally, in a world where privacy is scarce, it becomes the most valuable commodity.

The Winklevoss Factor and the Fine Print

The Winklevoss connection is crucial. They led the private placement, and Will McEvoy, a Principal at Winklevoss Capital, is now Cypherpunk's Chief Investment Officer. McEvoy claims other crypto treasuries failed because of "short-term, mercenary capital," while Cypherpunk has a "value-aligned" investor base.

That sounds good on paper, but what does it mean? Are these investors truly aligned with the long-term vision of Zcash, or are they simply chasing short-term gains fueled by hype? The long-term success of CYPH hinges on this alignment.

Now, let's talk about Zcash itself. It uses zero-knowledge proofs to shield transactions, making it more private than Bitcoin. Galaxy Digital research analyst Will Owens calls it "encrypted Bitcoin," resonating with "cypherpunk principles." The question is: does this privacy actually translate to real-world adoption and value? Zcash has processed tens of millions of transactions and consistently ranked among the top privacy coins by market capitalization. Its underlying protocol continues to evolve with major upgrades — including Halo 2, a trustless recursive proof system that eliminates the need for trusted setup ceremonies and enhances scalability. Nearly a decade after launch, Zcash remains one of the few digital assets with the potential for both Bitcoin-level decentralization and cutting-edge privacy, offering real utility with private yet auditable digital transactions.

The company's recent $58.9 million private placement was led by Winklevoss Capital – the family office of Gemini (GEMI) co-founders Tyler and Cameron Winklevoss. Cypherpunk said it aims to lift its holdings to at least 5% of Zcash’s total supply. Leap Therapeutics Rebrands as Cypherpunk; Expands Leadership Team to Drive New Zcash Treasury Strategy

With roughly 16.3 million ZEC in circulation, the company’s initial purchase already accounts for roughly one-fifth of that target. Zcash, like Bitcoin, has a fixed maximum supply of 21 million coins.

ZEC’s price has gained more than 1,400% over the last 12 months as privacy coins have captured investors’ attention amid rising regulatory scrutiny of the cryptocurrency markets.

And this is the part of the report that I find genuinely puzzling. ZEC's price has gained more than 1,400% over the last 12 months.

Cypherpunk, formerly known as Leap Therapeutics, rebranded itself earlier this week and announced that it would now be pivoting to a digital asset treasury (DAT) with Zcash as its primary token. The company also said it has used $50 million of its previously announced private placement to buy 203,775.27 ZEC at an average price of $245.37 per token – ZEC’s price is currently more than double that value at $573, rising 16% in the last 24 hours. Zcash (ZEC) Surges, Leap Therapeutics (LPTX) Jumps on Winklevoss-Backed Digital Asset Treasury

The Million-Dollar Question

So, what’s the play here? Are they genuinely betting on a future where privacy is paramount and Zcash dominates, or is this a calculated move to pump up the zcash price and then dump? It's difficult to say for sure.

The stock jumped as much as 97% midday trade after touching an intra-day high of $3.55, before paring some of its gains. Shares of the company, which is backed by the Winklewoss twins, were trading at around $3.15 at the time of writing. On Stocktwits, retail sentiment around the ticker trended in ‘extremely bullish’ territory with chatter at ‘extremely high’ levels over the past day.

Thor Torrens said, in a post on X, the stock’s rise reinforces his long-standing view that “privacy is not a trend.”

Former POTUS adviser and Zcash advisory panel member Thor Torrens said, in a post on X, the stock’s rise reinforces his long-standing view that “privacy is not a trend.”

This Smells Like a Pump and Dump (Maybe)

Here's the cold, hard truth: this whole thing has the faint but distinct odor of a pump-and-dump scheme. I'm not saying it is, but the sudden rebrand, the massive Zcash purchase, the Winklevoss backing, the claims of value-aligned investors—it all adds up to a narrative that's almost too perfect.

It's a risky bet, plain and simple. And investors should tread carefully, and do their own research.

Is Zcash a Good Investment?

The big question now is whether Zcash is a good investment. If you're a fan of privacy, then you'll probably be a fan of this coin, but remember that all investments have risk.

The Bottom Line

The bottom line is this: Cypherpunk's Zcash treasury strategy is a high-risk, high-reward gamble. If Zcash truly becomes the dominant privacy coin, they'll be sitting pretty. But if the regulatory winds shift or another privacy technology takes the lead, they're going to be left holding a very expensive bag of digital dust.

It's a Gamble on Privacy, Not a Sure Thing

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

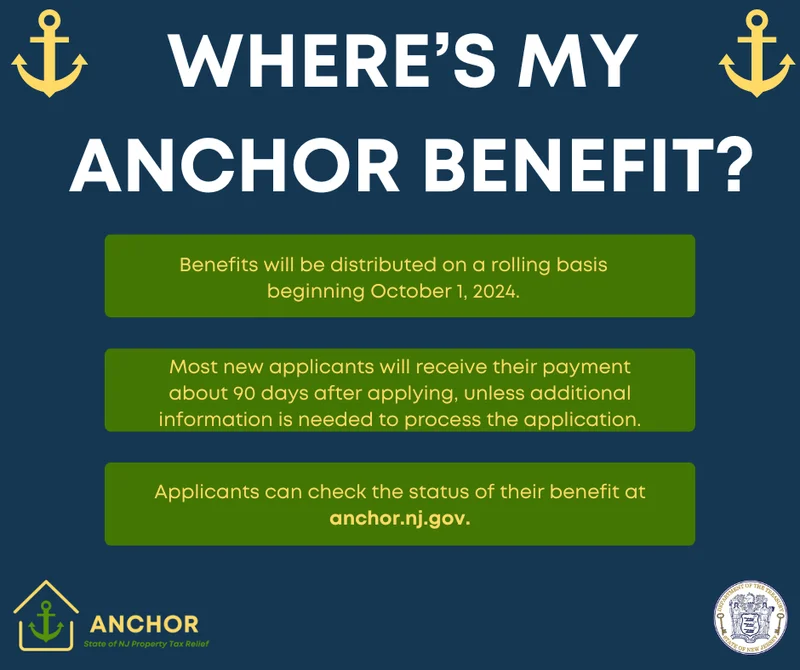

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Microsoft Stock: AI Revolution vs. Investor Jitters

- John Ternus at Apple: Net Worth, Age, and Tim Cook Succession Plans

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- USAA Insurance: Car, Life, and Health—What We Know

- Nvidia Stock: Huang's "Incredible News" vs. What the Price is Actually Doing

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)