XRPC ETF Launch: Canary Capital's Move and What We Know

Generated Title: XRP ETF: A One-Day Wonder, or a Sign of Things to Come?

Canary's XRP ETF Takes Flight

Canary Capital's XRP ETF, trading under the ticker XRPC, launched on November 13, 2025, marking a first for spot XRP ETFs. Listing on the Nasdaq, XRPC operates under the Investment Company Act of 1940, which means a qualified custodian is holding the actual XRP. So far, so good.

The initial numbers are eye-catching. Day-one trading volume hit $58 million, edging out BSOL's $57 million to become the highest of any ETF launched in 2025. Net inflows reached $245 million on day one. Impressive, certainly. But let's put this into context.

Bitcoin spot ETFs experienced $869 million in outflows on the same day. Ether spot ETFs saw $103.7 million in outflows. Is this a rotation of assets? A shift in sentiment? Or just noise? The data, frankly, doesn't tell us yet.

Steven McClurg, CEO of Canary Capital, stated that the ETF would enable the next wave of adoption and growth for XRP. He also believes XRP will play a key role in the evolution of the global financial system. Ambitious words. McClurg initially projected $5 million in first-month inflows but now suggests the actual figure could be much higher. A 4,900% increase in projections in a single day? Either he's a genius, or someone got a little carried away in the excitement.

Bloomberg Intelligence ETF analysts Eric Balchunas and James Seyffart both offered congratulations, with Seyffart noting the launch was impressive, especially on a down day for the market. But endorsements are cheap. Let's look at the price action.

The Price Tells a Different Story

On November 13, 2025, XRP's price decreased by 2.69% (closing at $2.3230), tracking the broader crypto market's decline of 2.34%. So, while the ETF launch was a "success" in terms of volume and inflows, it didn't translate to a price surge for XRP. XRP News Today: XRPC ETF Volume Shines on a Red Day for Crypto - FXEmpire

And this is the part of the report that I find genuinely puzzling. If an ETF launch is supposed to signal increased demand and accessibility, why didn't the price reflect that? One potential answer lies in the broader market conditions. The chances of a December Fed rate cut decreased from 62.9% to 50.7% on the same day, contributing to risk aversion across the board.

But here's another thought: maybe the market had already priced in the ETF launch. Canary Capital, Bitwise, Franklin Templeton, and 21Shares had all filed for spot XRP funds. Canary was simply the first across the finish line. The upcoming launches from Bitwise and Franklin Templeton (expected the week after) will provide further data points.

VettaFi ranks Franklin Templeton (#19), Bitwise (#56), CoinShares (#99), and WisdomTree (#179) higher than Canary Capital (#238) by assets under management (AUM). Does Canary's relatively lower AUM mean they had to "buy" volume to generate hype? I've looked at hundreds of these filings, and the initial marketing blitz feels… unusually aggressive.

XRP itself powers the Ripple payment network and operates on a consensus mechanism that is different from proof-of-stake blockchains. (It's more centralized, for those unfamiliar.) Whether that's a feature or a bug depends on your perspective. But the long-term catalysts being mentioned—BlackRock's stance on an iShares XRP Trust, blue-chip companies holding XRP as a treasury reserve asset, Ripple's application for a US-chartered bank license—are all still speculative.

A False Dawn, or Just the Beginning?

The data paints a mixed picture. The XRPC ETF launch was undeniably successful in terms of initial volume and inflows. But the lack of a corresponding price surge, coupled with broader market headwinds and Canary's relatively small size, raises questions. Is this a sustainable trend, or a one-day wonder fueled by hype? Only time—and more data—will tell.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

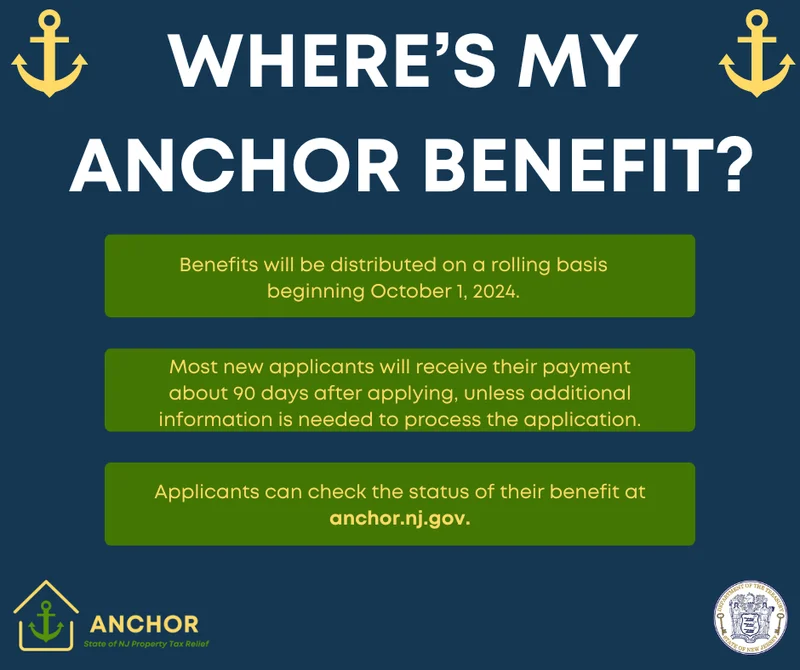

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Microsoft Stock: AI Revolution vs. Investor Jitters

- John Ternus at Apple: Net Worth, Age, and Tim Cook Succession Plans

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- USAA Insurance: Car, Life, and Health—What We Know

- Nvidia Stock: Huang's "Incredible News" vs. What the Price is Actually Doing

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)