Bitcoin Crashing: What Happened and Why?

Bitcoin's "Flash Crash" Was a Blip, Not a Burial: Why Crypto's Future Is Brighter Than Ever

Okay, everyone, let's take a deep breath. I know the headlines are screaming about Bitcoin's recent dip—the flash crash, the wiped-out open interest, the "extreme fear" in the market. But honestly? I'm not worried. In fact, I’m more excited than ever about what's coming next.

See, when I look at these short-term stumbles, I don't see a collapse. I see a pressure release. Think of it like this: Bitcoin, and crypto in general, is like a coiled spring. The more innovation, adoption, and excitement that gets packed in, the more tension builds. Sometimes, that tension needs to be released, and we get a little volatility. But that release clears the way for even more growth.

The Calm After the Storm

The recent headlines paint a grim picture, don't they? One article screams about Bitcoin dropping below $100,000. Another warns about a potential "bitcoin price crash nightmare." And yes, the October 10th crash did wipe out a staggering $19 billion in open interest.

But here's the thing: that's derivatives activity. That's leveraged speculation, not the core strength of Bitcoin itself. As Max Xu, Bybit's derivatives operations director, wisely pointed out, a lighter positioning and reduced mechanical pressure could actually help stabilize the market heading into 2026.

And let's not forget the broader context. Bitcoin is still holding remarkably well, even with this downside bias. I mean, it’s less than 20% below its all-time high! That's not a sign of a failing asset; that's a sign of resilience. It's like a seasoned marathon runner who stumbles a bit but quickly regains their stride.

Now, some analysts are pointing fingers at long-term holders selling off and institutional buying dropping below daily mining supply. Okay, fair enough. But I see something else: an opportunity. An opportunity for fresh demand to come in, for new investors to enter the market, and for Bitcoin to consolidate its position as a truly mature asset. What will they build on top of it? What new financial instruments will be created?

This brings me to something else I found fascinating: the UFC's parent company, TKO, signing a deal with Polymarket. A real-time Fan Prediction Scoreboard will debut during UFC broadcasts. This is more than just betting; it's about engagement, community, and bringing crypto-based prediction markets into the mainstream. This is exactly the kind of innovative application that will drive the next wave of adoption.

Plus, JPMorgan analysts believe Bitcoin's current estimated production cost of $94,000 acts as a historical price floor, suggesting limited downside.

The Bitcoin Fear and Greed Index has fallen to "extreme fear," its lowest level since March. But here's where I disagree with the doom-and-gloom crowd. This isn't an "alarming signal of things to come"; it's a buying opportunity! It's when everyone else is panicking that the smart money starts to accumulate. To me, the decline in the fear and greed index is a clear signal that the market is oversold, and a rebound is imminent.

And let's not forget about the potential impact of the government reopening. As Timot Lamarre at Unchained put it, Bitcoin is a "canary-in-the-coal-mine for liquidity drying up in the market." With the government back in action, more liquidity injected into the system will undoubtedly benefit Bitcoin's dollar price in the near term.

So, where does this leave us? Well, according to Bybit's Max Xu, open interest could gradually return to pre-shock levels by Q1 or Q2 2026 if macro conditions turn more favorable. That’s not exactly a doomsday scenario, is it?

I'm reminded of the early days of the internet. Remember all the dot-com crashes? The naysayers who declared the internet a fad? They couldn't see the bigger picture, the transformative potential that was just waiting to be unlocked. I honestly believe we're at a similar point with Bitcoin and crypto. We’re still in the early innings. What amazing things will we build together?

The Real Revolution Has Just Begun

The "flash crash" was a temporary setback, not a sign of impending doom. What matters is the underlying technology, the growing adoption, and the boundless potential of a decentralized future. The future is bright, my friends. In fact, it's dazzling.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

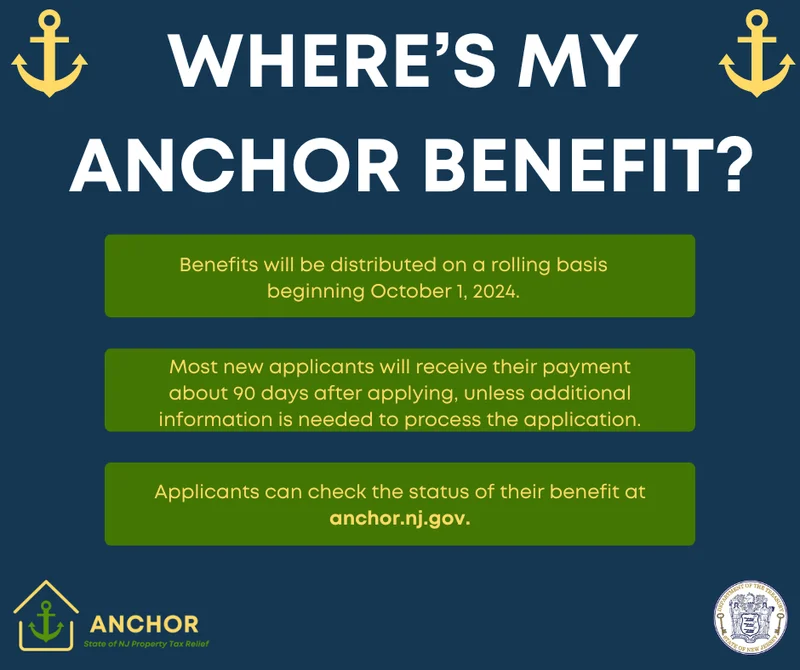

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Microsoft Stock: AI Revolution vs. Investor Jitters

- John Ternus at Apple: Net Worth, Age, and Tim Cook Succession Plans

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- USAA Insurance: Car, Life, and Health—What We Know

- Nvidia Stock: Huang's "Incredible News" vs. What the Price is Actually Doing

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)