US-China Trade Truce: What's Really Changed (and What Hasn't)

Title: Trade Truce or Tactical Pause? The Data Tells a Different Story

Okay, so everyone's buzzing about this U.S.-China trade truce. Tariff rollbacks, export controls eased, soybean purchases – sounds like we're all holding hands and singing "Kumbaya," right? Not so fast. Let's dig into the numbers.

The Devil's in the Details: Export Controls

The headlines scream "China rolls back export restrictions!" And yes, they did. Specifically, they reversed curbs on critical minerals and rare earth materials, along with some other goodies like gallium and germanium. But here's the kicker: Morgan Stanley economists point out that Beijing hasn't unwound the entire export-control framework. They're calling it a "calibrated choke-point." (A parenthetical clarification: I read that as, "We're still squeezing, just not as hard.")

Think of it like this: you're driving, and the engine light comes on. You don't fix the engine; you just disconnect the light. Problem "solved," right? That's what this feels like. The underlying tensions – the drive for self-reliance amidst "fierce international competition" – are still simmering. China's economy grew 4.8% in the third quarter of 2025, its slowest in a year. That's down from 5.2% in the second quarter. And guess what's weighing it down? You guessed it, the trade war.

And this is the part of the report that I find genuinely puzzling: If things were truly improving, why the continued emphasis on self-reliance? Why the push to link growth goals "more closely to strategic competition with the U.S."? It doesn’t scream “truce” to me.

Soybeans and Strategic Resolve

Then there's the soybean deal. China agrees to purchase 12 million metric tons by the end of 2025 and 25 million annually over the next three years. Sounds good, right? Farmers rejoice! But consider this: China needs soybeans. They're not doing us a favor; they're feeding their population. It's a transaction, not a treaty.

Neil Thomas at the Asia Society sums it up nicely: Beijing isn't chasing a grand bargain; they're seeking a truce to buy time and build leverage. He even suggests Xi is betting his "strategic resolve" will outlast Trump's. It's a chess game, not a love story. (And, let's be honest, given the players involved, I wouldn't bet on a love story anyway.)

The other element that is crucial to consider is the fentanyl precursor issue. Beijing added 13 fentanyl precursors to its export control list, requiring a license for shipments to the U.S., Mexico, and Canada. Now, on the surface, this looks like a real win. But the truth is that, with the rise of synthetic production routes, these precursor chemicals are becoming less and less relevant. So is this a real effort to curb the flow of fentanyl or a symbolic gesture? That's a question that's hard to answer with just numbers.

A Calculated Pause, Not a Breakthrough

The reality is more nuanced. The U.S.-China relationship is not defined by steady progress, but a series of calibrated escalations and de-escalations. As Morgan Stanley economists put it, "We view rolling negotiations, episodic flare-ups, and policy asymmetry as the new equilibrium." Tariffs thaw, rivalry simmers: U.S.–China trade truce enters uneasy phase - CNBC This truce is just another episode in that cycle. The underlying tensions remain, and the long-term trajectory is still uncertain.

Is This Really a Win-Win?

The question is, for whom is this truce most beneficial? Wendy Cutler at the Asia Society Policy Institute puts it best: "These steps suggest ‘so far, so good,’ but in reality, this is just the beginning...de-escalatory moves tend to be short-lived." What happens when the "truce" expires? What new levers will each side attempt to pull? And how will those moves impact the global economy? These are the questions we should be asking, not simply celebrating a temporary reprieve.

A Glimpse Behind the Curtain

It's just that, in the end, this isn't a story about a win for either country. It's a story about a system that's constantly trying to find equilibrium.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

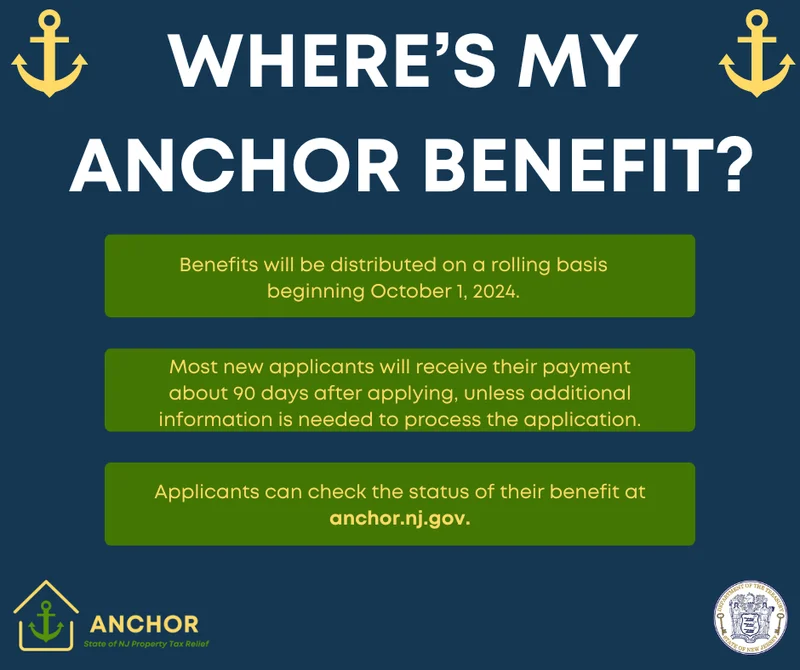

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- SpaceX Launch Today: Schedule, Starship, and What We Know

- Netflix Stock: The Split, the Price, and What Investors Overlook

- Maxi Doge Presale: Crypto News and Price Crash Concerns

- Microsoft Stock: AI Revolution vs. Investor Jitters

- John Ternus at Apple: Net Worth, Age, and Tim Cook Succession Plans

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)