Netflix Stock: The Split, the Price, and What Investors Overlook

Netflix's Stock Split: A Genius Move or Financial Sleight of Hand?

Netflix executed its 10-for-1 stock split on November 17, 2025. The move, lauded by some as a way to make the stock more accessible, effectively lowered the per-share price to around $111-$112. But did it actually change anything of substance? Let's dig into the numbers and see if this was a strategic masterstroke or just clever marketing.

The Illusion of Affordability

The primary rationale behind the split, according to Netflix, was to "reset the market price" to be more accessible to employees and smaller investors. Makes sense on the surface, right? A four-figure stock price can be intimidating. But let's be real: fractional shares exist. Any brokerage worth its salt allows you to buy a fraction of a share. So, the "accessibility" argument feels a bit…thin.

The company's authorized share count also jumped from roughly 4.99 billion to about 49.9 billion shares. That’s a tenfold increase, neatly mirroring the split. This was a necessary step to facilitate the split, but it also primes the pump for future dilution, should Netflix decide to raise capital through equity offerings. Is that likely? Hard to say. But the option is now firmly on the table.

Netflix's Q3 2025 earnings showed revenue around $11.5 billion, up roughly 17% year-over-year. Operating margin was about 28%, impacted by a one-time $600+ million tax expense in Brazil. Here's the critical point: the stock split didn't cause that growth. It simply reflected it. The underlying business momentum was already there. But, human psychology being what it is, the lower price could attract more retail investors, potentially boosting trading volume.

The Real Drivers: Ads and Engagement

Netflix is pushing hard on two fronts: advertising and engagement. The ad-supported tier now accounts for more than half of new signups in markets where it's offered, and advertising revenue is projected to more than double again in 2025. Live events, like boxing matches and NFL games, are also drawing significant viewership.

But here's where my analysis suggests a potential discrepancy. While Netflix touts its "AI-powered personalization" as a long-term driver of monetization, are these AI recommendations really that good? Or are they just pushing whatever content Netflix is trying to promote at the moment? Anecdotally, the online forums are filled with complaints about the algorithm pushing the same titles over and over. It's hard to quantify that sentiment, but it's a signal worth watching.

Rep. Cleo Fields disclosed a purchase of $100,001–$250,000 in Netflix stock on October 31, ahead of the split. Good for him, maybe he got some early insight. But insider buying (or in this case, a Congressman’s) doesn't automatically translate to a guaranteed return for everyone else. It's just one data point, and a potentially noisy one at that.

The Motley Fool piece called Netflix a “value-creating machine,” noting more than 300 million subscribers and a 103,000% gain since its IPO. The 103,000% gain is technically accurate, but it's also deeply misleading. It's a historical figure that tells you nothing about future performance. It's like saying a baseball player who hit 70 home runs 50 years ago is guaranteed to hit a lot of home runs today.

Smoke and Mirrors?

Wall Street analysts largely agree that Netflix isn’t cheap, but many still see room for upside if the company hits its growth and margin targets and its ad business continues to compound. Average price targets cluster around $134–$140 split-adjusted (roughly $1,340–$1,400 pre-split), implying 20–30% upside from current levels, depending on the source. This is the part of the report that I find genuinely puzzling. The analysts are essentially saying, "We like the stock, but it's already expensive." That's not exactly a ringing endorsement.

The Q3 margin miss, tied to a Brazilian tax case, reminds investors that regulatory surprises can hit profits unexpectedly. Which begs the question: what other hidden liabilities are lurking in Netflix's global operations? Details on the specifics of the tax dispute remain scarce, but the impact on the bottom line was undeniable.

It's Still the Same Company

On November 17, 2025, Netflix's stock split was a high-visibility event. Fundamentals remain strong, with revenue growth re-accelerating to around 17%. Wall Street generally likes the story, but at a premium price – consensus views Netflix as a leader worth owning, provided investors accept the valuation risk and competitive landscape. Netflix Stock Split Today: What November 17, 2025 Means for NFLX Investors

A Fool and His Money?

The stock split was a cosmetic change, not a fundamental one. The real story is whether Netflix can continue to grow its subscriber base, expand its advertising revenue, and fend off its rivals. The lower stock price might attract some new investors, but ultimately, it's the company's performance that will determine its long-term success. Don't get distracted by the shiny object; focus on the underlying business.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

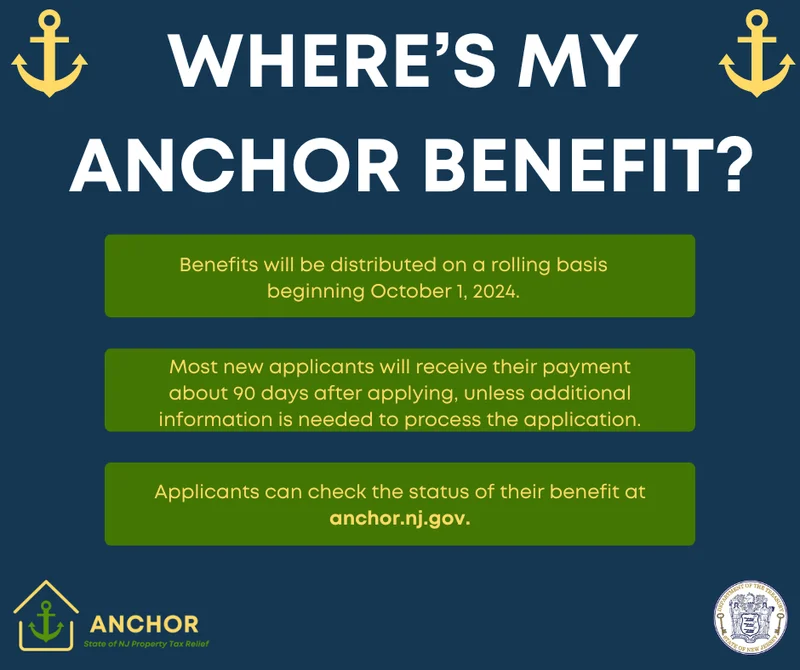

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: The Split, the Price, and What Investors Overlook

- Maxi Doge Presale: Crypto News and Price Crash Concerns

- Microsoft Stock: AI Revolution vs. Investor Jitters

- John Ternus at Apple: Net Worth, Age, and Tim Cook Succession Plans

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)