Maxi Doge Presale: Crypto News and Price Crash Concerns

ABSOLUTE DIRECTIVE: TITLE FULFILLMENT ###

[Generated Title]: Maxi Doge's $4M Presale: Is It a Smart Bet, or Just Meme-Driven Mania?

Cracking the Maxi Doge Hype: Data vs. Emotion

Dogecoin's little brother, Maxi Doge (MAXI), is making waves. Headlines scream about a $4 million presale, analysts predict 100x returns, and investors are apparently rushing in. But as a former hedge fund analyst, I’ve learned to approach these stories with a healthy dose of skepticism. The question isn't just "Is it going up?" but "Is it likely to go up based on verifiable data, or is this just a manufactured frenzy?"

Let's start with the basics. Maxi Doge is a meme coin, a digital asset whose value is primarily derived from online hype and community sentiment. The stated goal is to blend Dogecoin-style branding with real trading utility, a futures integration, and community trading features. This is a common promise in the meme coin world, and the execution is what matters.

The $4 million presale is, on the surface, impressive. However, we need to dig deeper. How many unique participants contributed? What was the average investment size? Were there any significant "whale" investments skewing the numbers? These are the questions that aren’t being asked. Without this data, the $4 million figure is just a vanity metric.

One argument circulating is that Maxi Doge offers a renewed Doge theme with modern humor and "1,000 times the upside potential." This is where the numbers need some serious scrutiny. Dogecoin has a market cap of around $25 billion (it fluctuates, naturally). For Maxi Doge to achieve 1,000x returns, it would need a market cap of $4 trillion – larger than Bitcoin. While not impossible, it's statistically improbable. The "upside potential" claim lacks a solid foundation in market realities.

The article mentions a 77% APY on staking MAXI tokens during the presale (this number varies slightly across sources—some say 76%, some 82%). High APYs are often used to incentivize early adoption, but they also come with risks. A high APY can be unsustainable, leading to inflation and a subsequent price crash when the staking rewards are no longer viable. It’s a short-term sugar rush that can lead to a long-term hangover. And this is the part of the report that I find genuinely puzzling. A 77% APY for a presale? You're essentially paying people to take on the highest possible risk, which suggests a lack of organic demand.

The Copycat Problem and Market Sentiment

Adding another layer of complexity is the emergence of fake Maxi Doge tokens. One scam token siphoned over $10 million from investors, highlighting the risks associated with the meme coin market. This isn't unique to Maxi Doge; copycat scams are rampant in the crypto space. But it underscores the importance of due diligence and the potential for confusion and manipulation. (See: Fake Maxi Doge Crypto Steals $10M: Real Maxi Doge Will Moon?)

The argument for Maxi Doge also rests on the idea that "altcoin season" is coming, and investors are looking for undervalued tokens. The Altcoin Season Index is currently at 32, up from 23 a week ago, suggesting a slight increase in altcoin momentum. However, the Altcoin Market Cap has declined from $1.79 trillion to $1.35 trillion (that's a 24.5% drop, to be more exact) which suggests that any "season" is far from guaranteed. It's a mixed bag of signals, not a clear green light.

The community sentiment around Maxi Doge is undeniably positive, with mentions of "Doge 2.0" and comparisons to early Dogecoin gains. However, online sentiment is not a reliable predictor of future performance. Social media can be easily manipulated, and the fear of missing out (FOMO) can drive irrational investment decisions.

A Calculated Gamble, Not a Sure Thing

Maxi Doge's $4 million presale is a notable achievement, but it doesn't guarantee success. The project faces significant challenges, including the volatility of the meme coin market, the risk of copycat scams, and the need to deliver on its promises of utility and community engagement. The high APY is a red flag, and the "1,000x potential" claim lacks a data-driven basis.

Ultimately, investing in Maxi Doge is a high-risk, high-reward proposition. It's a calculated gamble, not a sure thing. Investors should approach it with caution, do their own research, and only invest what they can afford to lose.

Hype Over Substance?

The data suggests this is more meme-driven mania than a smart bet.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

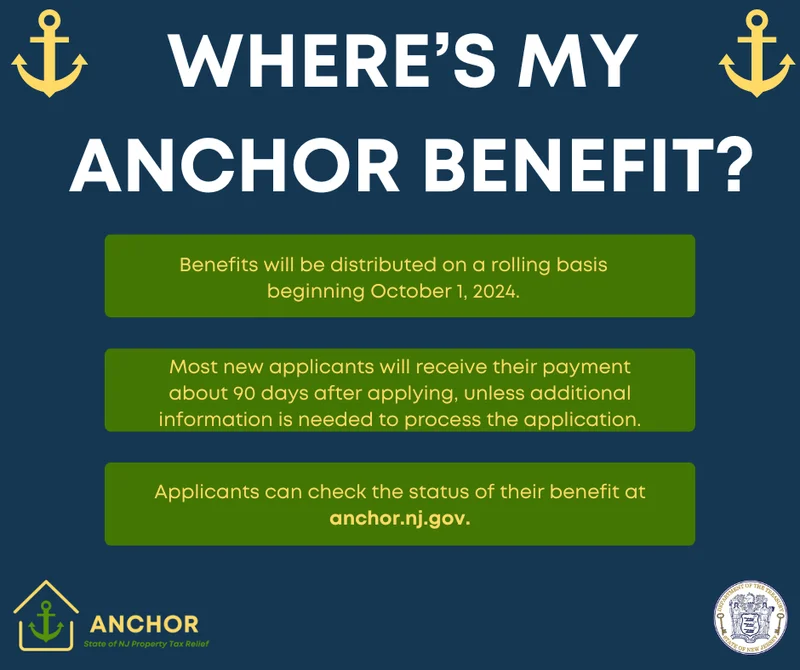

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: The Split, the Price, and What Investors Overlook

- Maxi Doge Presale: Crypto News and Price Crash Concerns

- Microsoft Stock: AI Revolution vs. Investor Jitters

- John Ternus at Apple: Net Worth, Age, and Tim Cook Succession Plans

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)