Alaska Permanent Fund: Amount, Payments, and Stimulus Impact

Title: Alaska's $1,000 Payout: A Dividend or a Distraction?

The Illusion of Abundance

Alaska's Permanent Fund Dividend (PFD)—a yearly payout to residents funded by oil and gas revenues—is slated to deliver $1,000 to roughly 600,000 Alaskans this year. On the surface, it appears to be a straightforward case of resource wealth being shared. But peeling back the layers reveals a more complex picture, one where the PFD might be serving as a distraction from deeper fiscal problems.

The history of the PFD is crucial. Established in 1976, it was intended to transform a one-time oil boom into a lasting benefit. For decades, a formula tied to the fund's market performance determined the payout. But that formula, according to the AP, would have yielded around $3,800 per resident this year. Instead, lawmakers opted for a drastically reduced $1,000 payout, citing "affordability concerns." (Translation: the state's broke.) Alaska Permanent Fund: 600,000 eligible Americans to receive $1,000 payout — Check eligibility, schedule & other details

This is where the numbers start to diverge from the narrative. While $1,000 is undoubtedly helpful—particularly for covering heating bills or winter tires—it's a far cry from the dividends of the past. And it masks a more troubling trend: declining oil revenues and a looming budget deficit. State projections indicate Alaska could face a $12 billion deficit by 2035 without significant changes. That's not a typo—$12 billion.

The real question isn't whether $1,000 is a nice bonus, but whether it's sustainable. Governor Dunleavy's proposed $3,900 PFD for 2026 is, frankly, delusional given the current fiscal trajectory. Senator Jesse Kiehl hit the nail on the head: "Without new revenues or identifying significant inefficiencies in spending, the current PFD formula is unsustainable." He's not wrong.

The Formula Fiasco

The issue boils down to a broken formula. The original PFD calculation, tied to the fund's performance, has been widely abandoned. Lawmakers have the power to tap into the fund's earnings for government operations, capped at 5% of the fund’s average value. However, with oil prices consistently underperforming (dropping from a projected $68 to $63 per barrel), the math simply doesn't work. The $1,000 payout is not based on a clear calculation; it's a politically expedient number.

I've looked at hundreds of these state budget reports, and the level of ambiguity surrounding the PFD calculation is unusual. It's like they're deliberately obfuscating the process.

The eligibility requirements for the PFD are fairly straightforward: be an Alaska resident for the entire year preceding the application, intend to remain a resident, and not claim residency elsewhere. You also need to have been physically present in Alaska for at least 72 consecutive hours during the past two years. Convicted felons and those jailed for felonies or misdemeanors in 2024 are excluded. These criteria are reasonable, but they don't address the fundamental problem: the shrinking pie.

And this is the part of the report that I find genuinely puzzling: the state continues to promote the PFD as a benefit of resource wealth, while simultaneously acknowledging its fiscal unsustainability. It's a cognitive dissonance that demands closer scrutiny.

The debate in Juneau is intensifying. Some argue that reducing the PFD would disproportionately harm vulnerable Alaskans, essentially acting as a regressive tax. Others contend that without changes, the entire fund—and the services it supports—could be at risk. The search for new revenue sources, from tax reforms to innovative investment strategies, is taking on new urgency. But until a viable solution is found, the PFD remains a band-aid on a much larger wound.

Smoke and Mirrors?

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

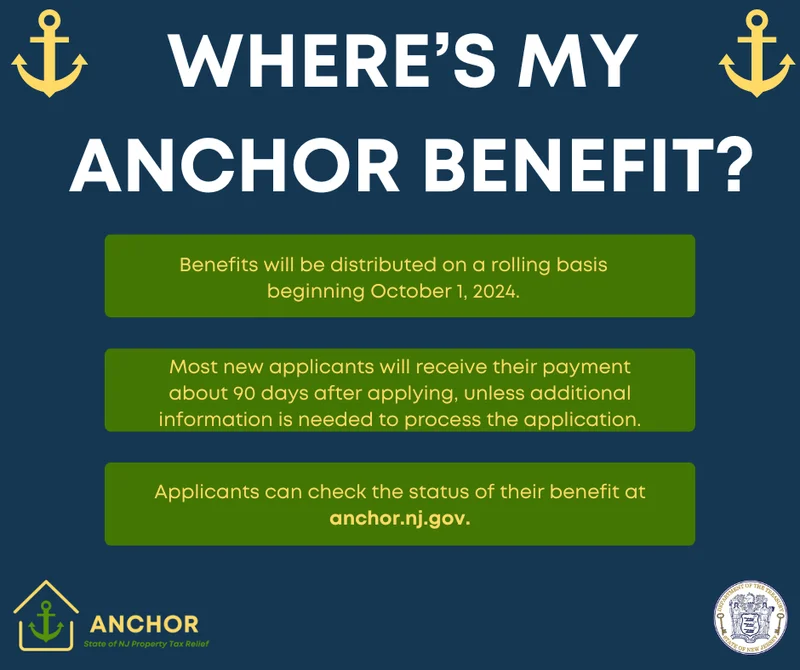

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: The Split, the Price, and What Investors Overlook

- Maxi Doge Presale: Crypto News and Price Crash Concerns

- Microsoft Stock: AI Revolution vs. Investor Jitters

- John Ternus at Apple: Net Worth, Age, and Tim Cook Succession Plans

- Google Stock: Berkshire Hathaway's Billion-Dollar Bet and What We Know

- CoinMarketCap: Crypto Prices, Bitcoin vs. XRP, and What's Real

- Indigo: What's the Story?

- Daniel Driscoll and the Army Overhaul: What It Means for the Future of Defense

- Mars' Orbit: What We Know About Earth, Venus, and the Other Planets

- Firo Hard Fork: What to Expect and Why It Matters

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (32)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (7)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)